of DeKalb Residents have a High School Diploma or Higher

of Residents 25-years-old and up have a Bachelor’s Degree of Higher

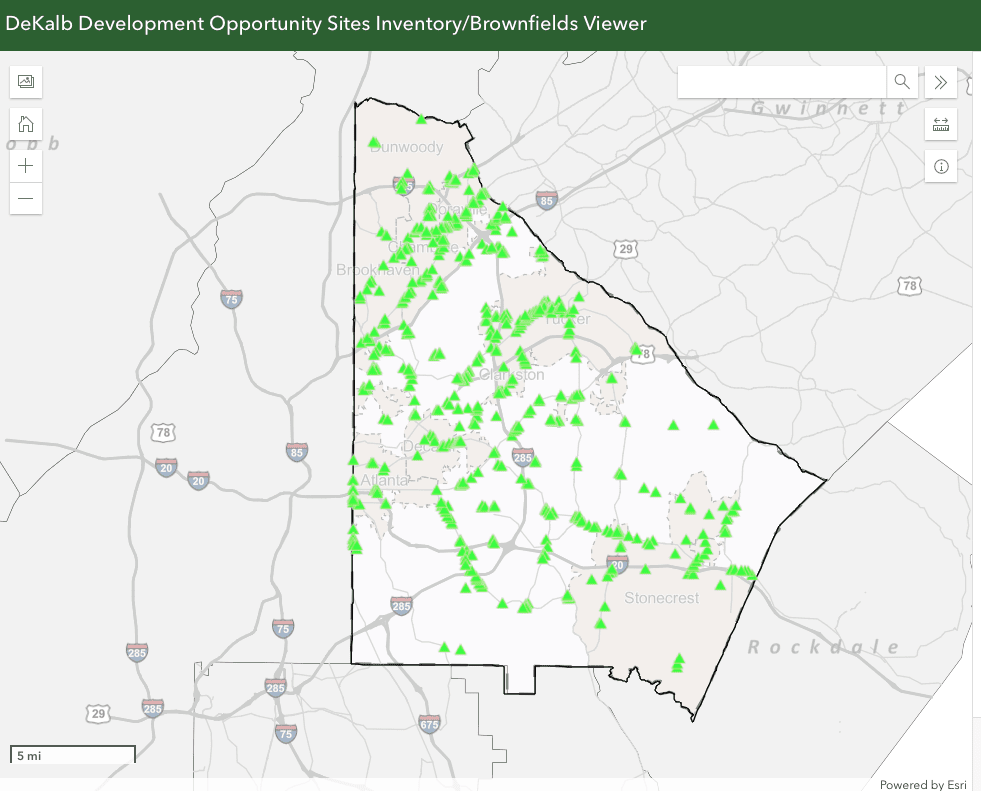

Locate & Expand

Our economic development team eagerly welcomes you to join the DeKalb County business community. We can help with site selection, business expansion, business retention, and more.

Local Business Resources

Decide DeKalb works closely with local and state governments, chambers of commerce, business associations, utility companies, colleges & universities, and private-sector employers, as well as neighborhood and community groups.

Talent & Workforce Development

We help businesses find quality workforce and talent so that they can innovate and grow. Decide DeKalb, in partnership with WorkSource DeKalb, helps businesses in DeKalb County access a full suite of hiring and training services to meet their workforce needs.

Down Payment Assistance Program

Receive a down payment grant to purchase, renovate, or refinance a home in DeKalb County. Whether you’re a homebuyer, loan originator, or realtor, we have the information you need.

Continue to Engage with Decide DeKalb

Reach New Heights with Decide DeKalb

Decide DeKalb is a leading authority in economic development known for attracting and retaining regional, national, and international companies to DeKalb County. We are committed to helping businesses maximize their potential and feel passionate about the future of local opportunity in DeKalb County. Let us know how our diverse array of economic development programs and services can help your business grow and thrive.